Transitions and change are challenging—especially for small business owners. It can be tough to wrap your head around leaving something you created and led, and even more complex if multiple people might be interested in taking over. That might be part of why family-owned businesses face more significant succession risks: According to a 2021 Family Business Survey conducted by PWC, only about one-third have a succession plan.

“Often the hardest part is the emotional aspect,” says Mark West, national vice president of business solutions for Principal®. “If you’ve dedicated much of your life to your business, and it’s part of your identity, it can be tough to walk away.”

It doesn’t have to be that way. A thoughtful, thorough succession planning benefits you—helping you figure out retirement income, for example—and is suitable for whoever is taking over—giving them time to figure out how to keep growing the business.

Need a succession planning template to get started or improve the one you have? These tips can help.

Step 1: Put a date on the calendar.

“Someday” isn’t good enough, even if you’re reluctant to give up work intertwined with your identity.

“If you’re the sole owner, it’s not too soon to start thinking about it in your 50s,” West says. “That way, you give yourself about a decade to develop and implement your plan. If you have co-owners, you’ll want to start even earlier.”

Step 2: Establish your business’s value.

An informal business valuation is an estimate based on an analysis of the company’s financial position. There are a few ways to create a valuation:

- Asset-based, which compares assets to liabilities or net cash value of everything if it were sold.

- Earnings value, which looks at past earnings and makes a reasonable assumption about future projections.

- Market value, which looks at similar businesses and recent sales.

Even if you have no immediate plans to sell, a business valuation is something you can and should update regularly. For one thing, it allows you to project how much life insurance you might want for business purposes to help protect your family against future loss.

“Succession planning is really a progression for a sole owner, including thinking about those years when you create a plan but haven’t transitioned out and what that looks like if something should happen to you,” West says.

Step 3: Figure out who wants the business.

Although family-owned businesses may offer a natural succession starting point, just because you don’t have a family doesn’t mean you can’t find a buyer. “People typically transition out in one of three ways: sell it, give it to someone in their family, or keep ownership but groom others to run it,” West says.

For the latter choice, key employees offer one option; owners of the competition may be another. If you don’t have someone in mind, a financial professional can help you identify possibilities.

When transitioning to the family, such as a child successfully, West says, “Think of them not as your child but as someone who will run your business. Do they make good decisions, communicate effectively, are they visible and impactful in the community, and do they care about employees as you do?”

Step 4: Hire experts.

A business succession strategy also includes a tax, legal, and financial professional. Working with an experienced team may help you accomplish a successful transition.

Step 5: Choose the type of succession strategy.

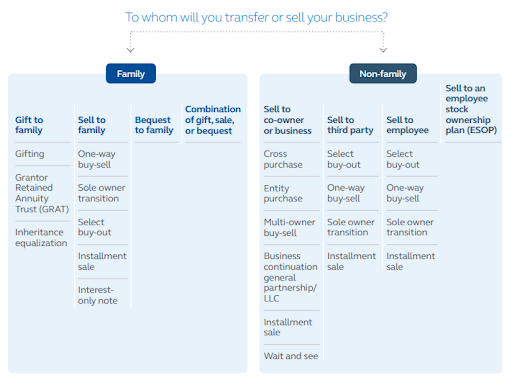

Who takes over your business (and if you’re related to them) may influence whether you sell, gift, or try a combination. That sale type should also accommodate continuity planning. “Many people haven’t thought about what’s going to happen if there’s an event like a divorce or bankruptcy, and what’s the road map if those events occur,” West says.

Use the chart below provided by Principal® to narrow down your options:

Step 6: Do what you can to retain valued employees.

Every step of succession planning helps you ensure the new owner doesn’t inherit a management team or staff riddled by departures. Retention or incentive plans linked to a required service period or specific date following the sale could help ensure a smooth transition. And life insurance for the business owner could help protect those promises made to key employees.

“Keep checking in with your succession plan, especially with key employees, to ensure everyone’s head is in the same place and nothing big has changed,” West says. “What made sense when you created the plan may not make sense when you’re closing in on retirement.”

What’s next?

Contact us for a self-conducted Business Needs Assessment to explore best practices to help protect your business, your employees, and your lifestyle.

We’re here to help!

Through its president, Cindy Fields, TEP, CFP ®, CWPP, CLU, ChFC, CLTC, RHU, REBC, MBA/Finance, and a licensed insurance broker, Loyalty Alliance is serving as a clearinghouse for insurance-related content. We thank Principal® for providing the content above, which we have adapted for this blog. It is relevant for all business owners wherever they are in their journey. Contact us to discuss solutions to YOUR needs.

- Different types of Life Insurance Policies - July 8, 2024

- Different Types of Buy Sell Agreements - May 31, 2024

- The Lifeline: Why Life Insurance Matters More Than You Think - May 14, 2024